CFO Message to Shareholders

When I was first introduced to Bathurst Metals Corp located in Nunavut, the gold exploration marketplace was not in a good way. Under-capitalized and unloved, the precious metal sector was not looking so good and as a finance professional, I knew there were many other sectors with better immediate prospects. The tech sector in particular was attracting capital and liquidity in a massive way – and the returns were downright fantastic but then something changed. The economy stumbled, the stock market dropped precipitously and the Fed went into action. Then a new player entered the game – Covid-19. Where Fed’s job was somewhat straightforward initially – now with Covid-19, it became a much more onerous task.

Covid-19 turned out to a global event and required a global monetary response. Mounting unemployment coupled with falling expenditures, both personal and enterprise, have laid waste to an otherwise healthy economy. One of the easiest and arguably the most effective policy tools of the Central Banks is Quantitative Easing. And by gosh every Central Bankers backed up the truck and began to print their respective currencies, lowered their interest rates and bought back bonds. Today we have over $18T (source: Bloomberg Dec 2020) in negative yielding debt where Portugal now yields 0% and the UST 10yr .90%. In fact, close to 60% of the world central banks have their policy rates below 1% – which is feat not matched in over 70yrs (source: BIS, TS Lombard).

Today we have over $18T (source: Bloomberg Dec 2020) in negative yielding debt where Portugal now yields 0% and the UST 10yr .90%. In fact, close to 60% of the world central banks have their policy rates below 1% – which is feat not matched in over 70yrs (source: BIS, TS Lombard).

That liquidity has to find a home, and let’s face it, who in his right mind would buy a bond guaranteed to lose money. The stoc k markets have been the main beneficiaries to a point where the S&P 500 Price Earnings ratio (P/E) is mid to high 20’s in an economy with double digit unemployment which in normal recessionary times one would expect 10-15x. By another measure, the Total Stock Market Capitalization to GDP ratio is pushing 180% where prior to 2010 it ranged between 40-100% – which is the highest its ever been since measuring. Clearly the stock markets are fully valued.

k markets have been the main beneficiaries to a point where the S&P 500 Price Earnings ratio (P/E) is mid to high 20’s in an economy with double digit unemployment which in normal recessionary times one would expect 10-15x. By another measure, the Total Stock Market Capitalization to GDP ratio is pushing 180% where prior to 2010 it ranged between 40-100% – which is the highest its ever been since measuring. Clearly the stock markets are fully valued.

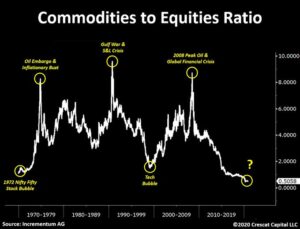

But you wouldn’t think that looking at the commodities and precious metal markets. The Commodities to Equities Ratio is now at .5058, lower than the Tech Bubble of 2000 and the most recent peak of 8.75 in 2008 (source: Incrementum AG Nov 2020). Clearly this precious metal sector is undervalued and under owned. But I digress…

Now back to Bathurst Metals Corp. The goal of our management is to increase corporate & shareholder value on a consistent basis. It is my belief that corporate & shareholder value represents the sum total of that value attributable to our stakeholders. Of course, Bathurst has to deliver milestones and travel up that value chain. And I think we’ve done the best we can to date in light of the challenges we faced. It will take all of us working hard, collaborating and staying focused to come out of these times stronger and ready for the future.

Bathurst represents a compelling investment opportunity in the gold exploration sector and we believe the historical work on our various properties shows excellent potential gold, silver, platinum and palladium deposits. By continuing to explore, drill our assets and prove up results, we believe we can add significant corporate & shareholder value in an improving global precious metal marketplace.

It is our intent, under the current challenging conditions of our economic environment, to carefully determine the timing and scale of investments to apply to our current assets in Nunavut. While doing so, we will remain on course with our aim of achieving our long-term vision of creating a world class precious metal exploration company.